- CQF Program

- Events

- Resources »

- Membership

- Careers »

- About Us »

Open Filter

Optimal Hedging Strategies With an Application to Hedge Fund Replication

In this paper, the authors discuss the technical challenges of implementing a multivariate extension of Dybvig (1988) model and discuss the possible solutions.

Wed 15 Nov 2023

Hedging under SABR Model

This article takes a fresh look at the delta and vega risks within the SABR stochastic volatility model Hagan et al. (2002).

Tue 21 Feb 2023

Introduction to Variance Swaps

This article introduces the properties of variance swaps, and gives insights into the hedging and valuation of these instruments from the particular lens of an option trader.

Thu 1 Dec 2022

Amaranthus Extermino

What does the 2006 Amaranth Advisors natural gas hedge fund disaster tell us about the state of hedge funds?

Tue 4 Jan 2022

Introduction to Variance Swaps

The purpose of this article is to introduce the properties of variance swaps, and give insights into the hedging and valuation of these instruments from the particular lens of an option trader.

Tue 7 Dec 2021

Numerical Methods for the Markov Functional Model

Some numerical methods for efficient implementation of the 1- and 2-factor Markov Functional models of interest rate derivatives are proposed.

Thu 4 Nov 2021

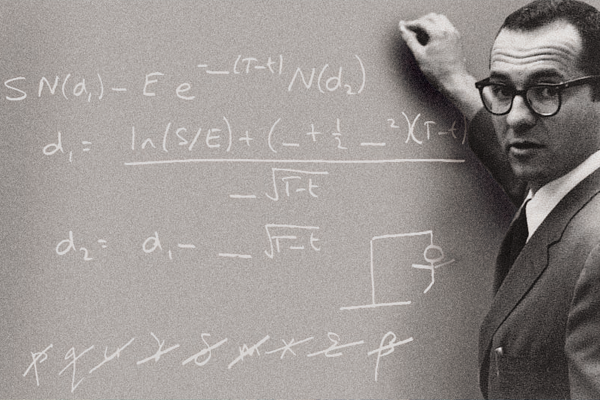

What I Knew and When I Knew It - Part 2

Mathematician, Ed Thorp, looks back to the creation of the world's first market-neutral hedge fund and pre-empting Black-Scholes.

Tue 25 Aug 2020

Sensible Sensitivities for the SABR Model

In this article published by the Wilmott magazine, Chibane, Miao and Xu develop a new methodology for computing smile sensitivities (Vegas) for European securities priced under the SABR model when the latter is calibrated to more market volatilities than the number of available model parameters.

Tue 19 May 2020

The Honest Truth about Dishonesty: Market Manipulation and Why Some Strings are More Powerful than Others

This short piece by Edward Talisse looks at the ways in which financial institutions and individuals have manipulated the market over the years and what it means for the future.

Fri 24 Apr 2015

Black-Litterman in Continuous Time: The Case for Filtering

Dr. Mark Davis and Dr. Sébastien Lleo extend the Black–Litterman approach to a continuous time setting.

Fri 13 Feb 2015