- CQF Program

- Events

- Resources »

- Membership

- Careers »

- About Us »

Open Filter

Primer on Arbitrage and Asset Pricing

In this paper, the authors go back to basics with arbitrage and asset pricing.

Thu 19 Oct 2023

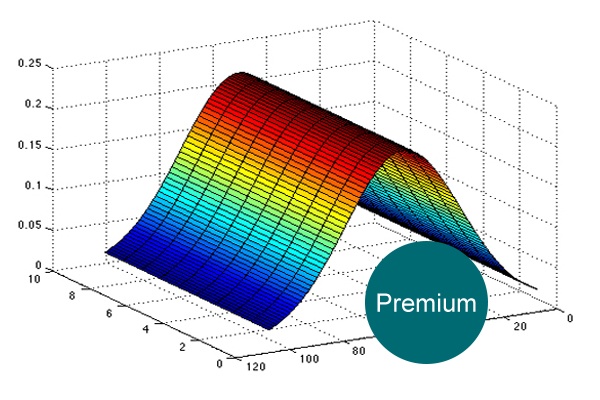

Sequential Modeling of Dependent Jump Processes

In this article published by WIlmott magazine, Mai, Scherer, and Schulz present a new methodology to generalize univariate models to the multivariate case.

Mon 20 Jul 2020

Navigating Stock Market Crashes in the Brexit Trump Era (Presentation Slides)

Presentation slides for Dr. Bill Ziemba's talk - 'Navigating Stock Market Crashes in the Brexit Trump Era'.

Wed 31 May 2017

Shiny New Toys: Does Wealth Management Need A.I.?

In this article, Greg Davies examines the allure of adopting artificial intelligence as a solution for a range of business problems in Wealth Management and the need to appropriately match solutions to problems.

Tue 30 May 2017

Explorations in Asset Returns

In this white paper CQF faculty member Dr. Richard Diamond provides an in-depth exploration in asset returns.

Sun 24 Jul 2016

Black-Litterman in Continuous Time: The Case for Filtering

Dr. Mark Davis and Dr. Sébastien Lleo extend the Black–Litterman approach to a continuous time setting.

Fri 13 Feb 2015

Ferdinand the Bull

In his latest commentary, Edward Talisse likens the financials and banks to that off a bull, and explains where it all went wrong in the 2008 financial crisis.

Wed 1 Oct 2014

Asset Shortage

The difference between the amount or stock of assets outstanding and its tradable flow adjusted float is rarely discussed by research analysts and advisors.

Thu 4 Sep 2014

Anything Built By the FED, Can Also Be Destroyed

In this commentary, Edward Talisse examines the year’s bond investment, looking closely at the USA and countries in Europe including Spain, Italy and Greece.

Wed 30 Jul 2014

Geezers Need Excitement: Trading Jitters and the Volume Myth

Declining trading volumes is a fact. But the idea that high volume is good and low volume is bad is a fallacy. In this article, Ed Talisse looks at 5 market shocks that are driving trading volumes lower.

Tue 1 Jul 2014